Irs Gas Reimbursement Amount 2024

Irs Gas Reimbursement Amount 2024. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: The standard reimbursement rate for 2024 is currently set to 67 cents per mile, which is 1.5 cents higher than it was for 2023, when it stood at 65.5 cents per mile.

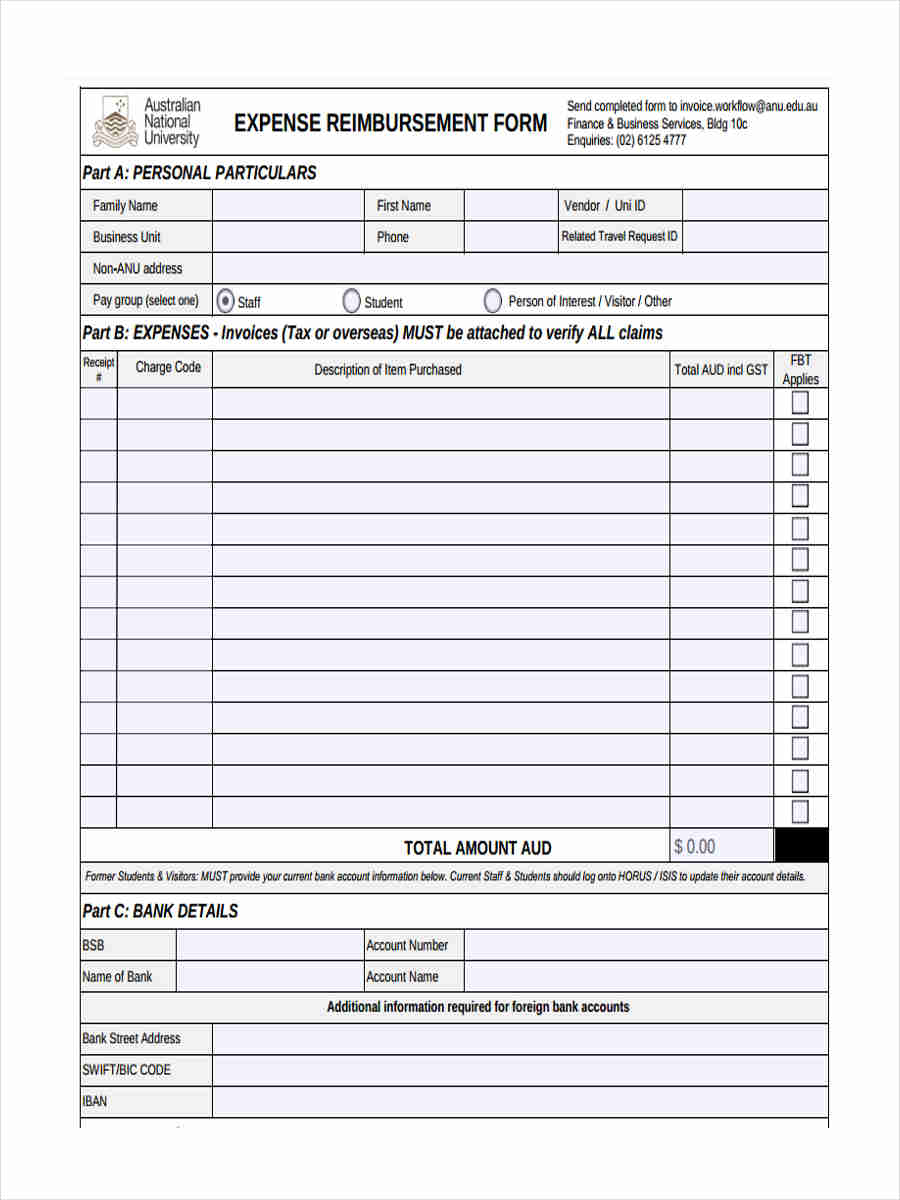

Calculate the deduction by multiplying the total actual expenses incurred (gas, maintenance, oil) by the business use percentage. The increase began on january 1 and raised the rate from.

Moving ( Military Only ):

The standard reimbursement rate for 2024 is currently set to 67 cents per mile, which is 1.5 cents higher than it was for 2023, when it stood at 65.5 cents per mile.

Click On The Calculate Button To Determine The Reimbursement Amount.

17 rows the standard mileage rates for 2023 are:

Irs Gas Reimbursement Amount 2024 Images References :

Source: kettyqjennilee.pages.dev

Source: kettyqjennilee.pages.dev

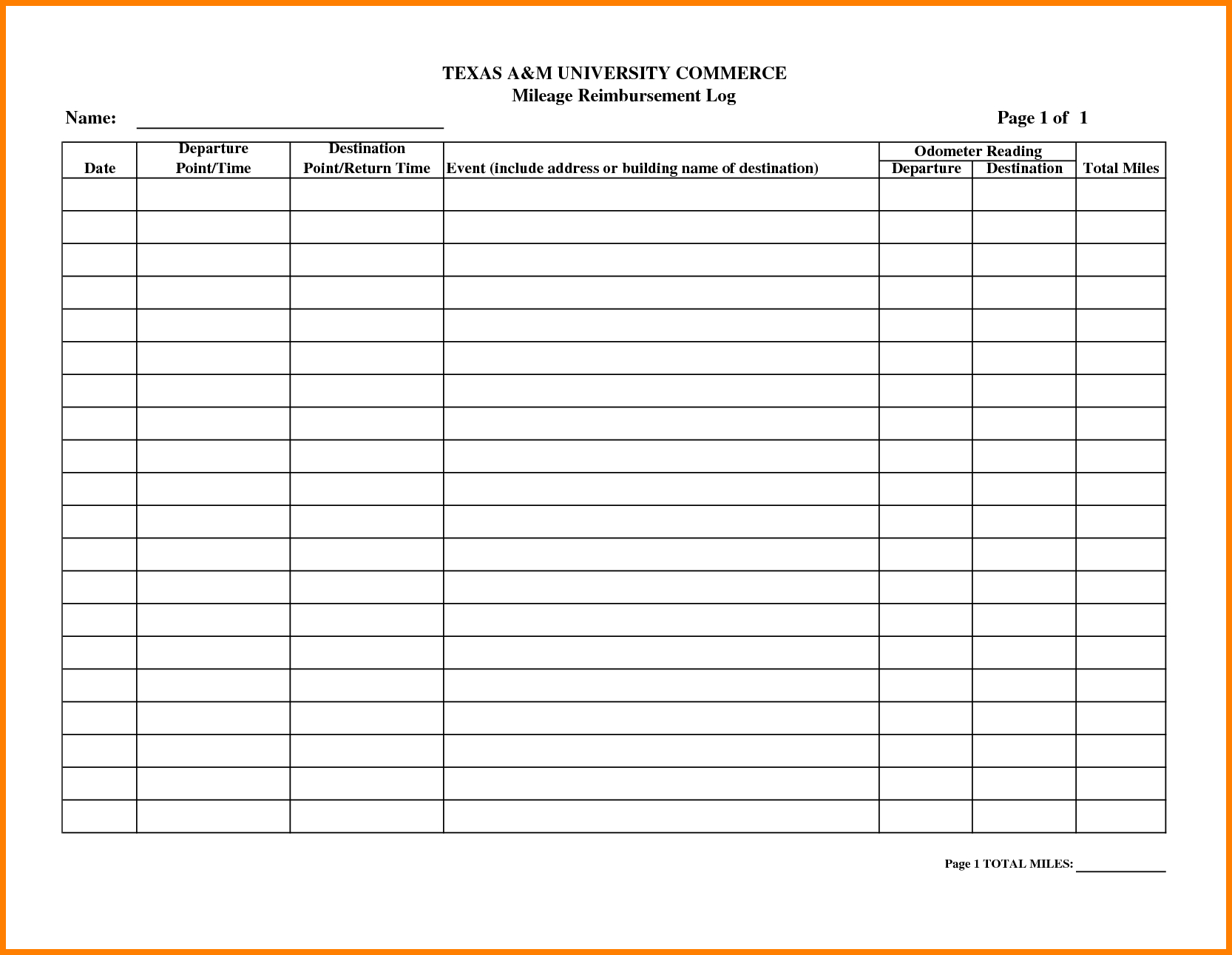

Irs Mileage 2024 Reimbursement Rate 2024 Heda Rachel, Remember to check for new guidelines. Moving ( military only ):

Source: www.thetechedvocate.org

Source: www.thetechedvocate.org

How to calculate gas reimbursement The Tech Edvocate, By inputting the tax year and total miles. How to calculate mileage for taxes.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, 67 cents per mile for business use (up 1.5 cents from 2023.) 21 cents per. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel within the.

Source: www.marca.com

Source: www.marca.com

IRS Reimbursement rate 2022 Can you write off gas on taxes? Marca, Calculate the deduction by multiplying the total actual expenses incurred (gas, maintenance, oil) by the business use percentage. 67 cents per mile for business use (up 1.5 cents from 2023.) 21 cents per.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, 2024 irs mileage reimbursement rates. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Source: www.marca.com

Source: www.marca.com

IRS Gas Reimbursement 2022 Will the mileage reimbursement rate go up, For automobiles a taxpayer uses for business purposes, the portion of the business standard mileage rate treated as. *in 2022, the irs mileage rate was.

Source: winonawbarbi.pages.dev

Source: winonawbarbi.pages.dev

Fuel Mileage Reimbursement 2024 Zelda Katrinka, For cafeteria plans that permit the carryover of. For 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile.

Source: emeraqpriscilla.pages.dev

Source: emeraqpriscilla.pages.dev

Irs Expense Reimbursement Guidelines 2024 Hanni Petronia, *in 2022, the irs mileage rate was. For example, gas, oil, parking, insurance, lease payments, maintenance, repairs, etc.

Source: vhairiaayina.blogspot.com

Source: vhairiaayina.blogspot.com

Calculate gas mileage reimbursement VhairiAayina, For 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile. 17 rows the standard mileage rates for 2023 are:

Source: carlienettie.pages.dev

Source: carlienettie.pages.dev

Current Irs Mileage Reimbursement Rate 2024 Yetta Katerine, 67 cents per mile for business use (up 1.5 cents from 2023.) 21 cents per. For cafeteria plans that permit the carryover of.

67 Cents Per Mile Driven For Business Use, Up.

The 2023 mileage reimbursement rate for business was 65.5 cents per mile, 22 cents for medical and moving miles, and 14 cents for miles in the service of.

For 2024, The Irs' Standard Mileage Rates Are $0.67 Per Mile For Business, $0.21 Per Mile For Medical Or Moving, And $0.14 Per Mile.

The increase began on january 1 and raised the rate from.

Category: 2024